Exhibit 99.26

| B M CHATRATH & CO LLP | REGD. OFFICE : CENTRE POINT, 4th FLOOR, Suite No. 440 |

| (FORMERLY B M CHATRATH & CO.) | 21, HEMANTA BASU SARANI, KOLKATA - 700 001 |

| CHARTERED ACCOUNTANTS | TEL : 2248-4575/4667/6810/6798, 2210-1385, 2248-9934 |

| LLPIN : AAJ-0682 | E-mail: bmccal@bmchatrath.in |

| website : www.bmchatrath.com |

Report on Review of Interim Financial Information

To,

The Board of Directors,

UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED

Introduction

We have reviewed the accompanying condensed balance sheet of UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED (“the Company”) as of October 31, 2022 and the related condensed statements of profit & loss for the seven-month period then ended. Management is responsible for the preparation and presentation of this interim financial information in accordance with the Accounting Principles generally accepted in India including the Accounting Standard 25 specified under Section 133 of the Act read with Rule 7 of the Companies (Accounts) Rules, 2014 (as Amended). Our responsibility is to express a conclusion on this interim financial information based on our review.

Scope of Review

We conducted our review in accordance with Standard on Review Engagements (SRE) 2410, “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”. A review of interim financial information consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with Standards on Auditing and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the accompanying interim financial information is not prepared, in all material respects, in accordance with the Accounting Principles generally accepted in India including the Accounting Standard 25 specified under Section 133 of the Act read with Rule 7 of the Companies (Accounts) Rules, 2014 (as Amended).

Restriction on Use and Distribution

The specified financial statements have been prepared for purposes of providing information to the Company to enable it to prepare the group financial statements. As a result, the specified financials are not a complete set of financial statements of UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED in accordance with Accounting Principles generally accepted in India including the Accounting Standard 25 specified under Section 133 of the Act read with Rule 7 of the Companies (Accounts) Rules, 2014 (as Amended) and are not intended to present fairly, in all material respects of the financial position of the Company as of October 31st 2022 and of its financial performance, for the seven months period then ended in accordance with Accounting Principles generally accepted in India including the Accounting Standard 25 specified under Section 133 of the Act read with Rule 7 of the Companies (Accounts) Rules, 2014 (as Amended). The specified financials may, therefore, not be suitable for another purpose.

| For B M Chatrath & Co LLP | |

| Chartered Accountants | |

| FRN: 301011E/E300025 | |

| /s/ Priya Agarwal | |

| Priya Agarwal | |

| Partner | |

| Membership Number 303874 | |

| Place: Kolkata | UDIN: 23303874BGTXCA4576 |

| Date: 6th February 2023 |

NOIDA:- D-26, 2nd Floor, Sector - 3, Noida - 201301 (Uttar Pradesh), Ph No. - 0120-4593360, 0120-4593361

DELHI:- Flat No. - 10, 45 Friends Colony East, New Delhi 110065

MUMBAI:- 104, Building No. B69. Nitin Shanti Nagar CHSL, Shanti Nagar, Sector -1, Mira Road East. Dist. - Thane, Mumbai - 401107

HYDERABAD:- Mangalgiri Vinaygar Apartments, Flat No. - 202, 8-2-616/3/E/2, Road No - 10, Banjara Hills, Pin : 500034

JAIPUR:- B-269, Janta Colony, Jaipur-302004, Ph : 0141-2601727

UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED

CONDENSED BALANCE SHEET AS AT 31ST OCT 2022

| Oct 2022 : Average Ex Rate : 78.2378 | Mar 2022 : Average Ex Rate : 73.9245 | |||||||||||||||||||

| Note No. | As

at (Rs. In Lacs) | As

at (in $k) | As

at (Rs. In Lacs) | As

at (in $k) | ||||||||||||||||

| I. EQUITY AND LIABILITIES | ||||||||||||||||||||

| 1. Shareholders’ Funds | ||||||||||||||||||||

| (a) Share Capital | 2 | 130.86 | 167.26 | 130.86 | 177.02 | |||||||||||||||

| (b) Reserves and Surplus | 3 | 1,498.30 | 1,915.07 | 1,239.17 | 1,676.27 | |||||||||||||||

| 1,629.17 | 2,082.33 | 1,370.03 | 1,853.29 | |||||||||||||||||

| 2. Non-Current Liabilities | ||||||||||||||||||||

| (a) Long- Term Borrowings | 4 | 7.80 | 9.97 | 12.31 | 16.65 | |||||||||||||||

| (b) Long-Term Provisions | 5 | 369.57 | 472.37 | 221.40 | 299.50 | |||||||||||||||

| 377.37 | 482.34 | 233.71 | 316.15 | |||||||||||||||||

| 3. Current Liabilities | ||||||||||||||||||||

| (a) Short-Term Borrowings | 6 | 7.79 | 9.96 | 8.60 | 11.64 | |||||||||||||||

| (b) Trade Payables | 7 | 9,607.41 | 12,279.75 | 8,743.51 | 11,827.60 | |||||||||||||||

| (c) Other Current Liabilities | 8 | 100.64 | 128.64 | 111.42 | 150.72 | |||||||||||||||

| (d) Short-Term Provisions | 9 | 172.40 | 220.35 | 332.65 | 449.99 | |||||||||||||||

| 9,888.24 | 12,638.70 | 9,196.18 | 12,439.95 | |||||||||||||||||

| 1 1,894.77 | 15,203.37 | 10,799.92 | 14,609.39 | |||||||||||||||||

| II. ASSETS | ||||||||||||||||||||

| 1. Non-Current Assets | ||||||||||||||||||||

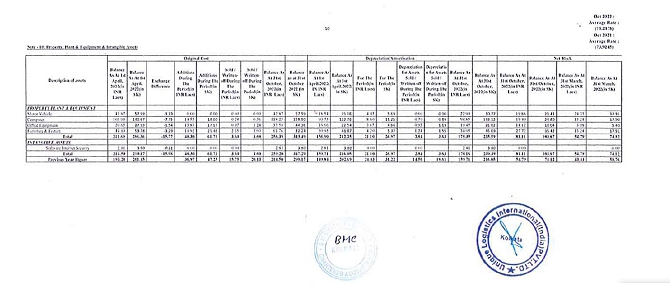

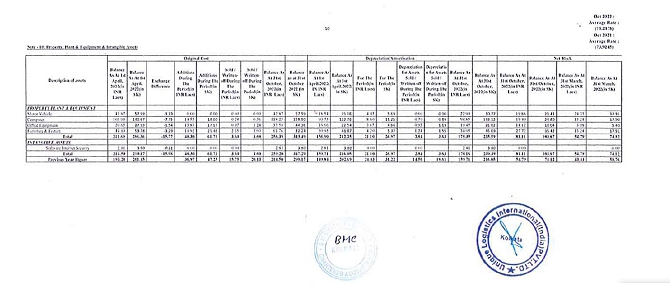

| (a) Property, Plant & Equipment & Intangible Assets | ||||||||||||||||||||

| (i) Property, Plant & Equipment | 10 | 81.11 | 103.67 | 54.79 | 74.12 | |||||||||||||||

| (ii) Intangible Assets | - | - | - | |||||||||||||||||

| (iii) Capital Work in Progress | - | - | - | |||||||||||||||||

| 81.11 | 103.67 | 54.79 | 74.12 | |||||||||||||||||

| (c) Deferred Tax Assets (net) | 39.88 | 50.97 | 43.12 | 58.33 | ||||||||||||||||

| (d) Long-Term Loans and Advances | 11 | 261.28 | 333.96 | 305.12 | 412.74 | |||||||||||||||

| 301.16 | 384.93 | 348.24 | 471.07 | |||||||||||||||||

| 2. Current Assets | ||||||||||||||||||||

| (a) Trade Receivables | 12 | 8,919.55 | 11,400.57 | 8,696.56 | 11,764.12 | |||||||||||||||

| (b) Cash and Cash Equivalents | 13 | 1,803.60 | 2,305.28 | 1,005.12 | 1,359.66 | |||||||||||||||

| (c) Short-Term Loans and Advances | 14 | 33.72 | 43.10 | 21.77 | 29.44 | |||||||||||||||

| (d) Other Current Asset | 15 | 755.62 | 965.81 | 673.44 | 910.98 | |||||||||||||||

| 11,512.50 | 14,714.76 | 10,396.89 | 14,064.20 | |||||||||||||||||

| 1 1,894.77 | 15,203.37 | 10,799.92 | 14,609.39 | |||||||||||||||||

| Significant Accounting Policies | 1 | |||||||||||||||||||

The accompaying notes are an integral part of the financial statements.

In terms of our report attached

| For B M CHATRATH & Co LLP | For UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED | |

| Chartered Accountants | ||

| Firm Registration No. 301011E/E300025 | /s/ Sanjeev Ranjan Ambasta | |

| Sanjeev Ranjan Ambasta - General Manager Finance | ||

| /s/ Priya Agarwal | ||

| Priya Agarwal | ||

| Partner | ||

| Membership No. - 303874 | ||

| Place: KOLKATA | ||

| Date: 06-02-2023 |

UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED

CONDENSED STATEMENT OF PROFIT AND LOSS FOR THE SEVEN MONTHS PERIOD ENDED 31ST OCT 2022

| Oct 2022 : Average Ex Rate: 78.2378 | Oct 2021 : Average Ex Rate : 73.9245 | |||||||||||||||||||

| For the Seven mouths period ended 31st Oct. 2022 | For the Seven months period ended 31st Oct, 2022 | For the Seven months period ended 31st Oct, 2021 | For the Seven months period ended 31st Oct, 2021 | |||||||||||||||||

| Note No. | Amount (Rs. In Lacs) | Amount (in $k) | Amount (Rs. In Lacs) | Amount (in $k) | ||||||||||||||||

| I. INCOME | ||||||||||||||||||||

| (a) Revenue from Operations (Gross) | 16 | 21,877 62 | 27,962.98 | 30,916 22 | 41,821 31 | |||||||||||||||

| (b) Other Income | 17 | 118.15 | 151.01 | 3.62 | 4.90 | |||||||||||||||

| Total Income | 21,995.77 | 28,114.00 | 30,919.84 | 41,826.24 | ||||||||||||||||

| II. EXPENSES | ||||||||||||||||||||

| (a) Operating Expenses | 18 | 20,188.21 | 25,803.66 | 29.313.33 | 39,653.06 | |||||||||||||||

| (b) Employee Benefits Expense | 19 | 1,102.33 | 1,408.95 | 1,012.15 | 1,369.16 | |||||||||||||||

| (c) Finance Cost | 20 | 0.83 | 1.07 | 1.08 | 1.46 | |||||||||||||||

| (d) Depreciation and Amortisation Expense | 21 | 21.10 | 26.97 | 12.22 | 16.53 | |||||||||||||||

| (e) Other Expenses | 22 | 329.91 | 421.68 | 234.38 | 317.00 | |||||||||||||||

| Total Expenses | 21,642.39 | 27,662.32 | 30,573.16 | 41,357.27 | ||||||||||||||||

| III. Profit Before Exceptional and Extraordinary Items and Tax (I-II) | 353.38 | 451.68 | 346.68 | 468.97 | ||||||||||||||||

| Exceptional Items | - | |||||||||||||||||||

| IV. Profit Before Extraordinary Items and Tax | 353.38 | 451.68 | 346.68 | 468.97 | ||||||||||||||||

| Extraordinary Items | - | - | - | |||||||||||||||||

| V. Profit Before Tax | 353.38 | 451.68 | 346.68 | 468.97 | ||||||||||||||||

| VI. Tax Expense: | ||||||||||||||||||||

| (a) Current fax | 23 | 91.00 | 116.31 | 88.75 | 120.05 | |||||||||||||||

| (b) Deferred Tax Expense / (Income) | 24 | 3.25 | 4.15 | - | - | |||||||||||||||

| 94.25 | 120.46 | 88.75 | 120.05 | |||||||||||||||||

| 259.14 | 331.22 | 257.93 | 348.91 | |||||||||||||||||

| VII. Profit After Taxation (V-VI) | ||||||||||||||||||||

| Basic and diluted Earning per Share (in Rs.) | 25 | 19.80 | 0.25 | 19.71 | 0.26 | |||||||||||||||

| Significant Accounting Policies | 1 | |||||||||||||||||||

The accompaying notes are an integral part of the financial statements.

In terms of our report attached

| For B M CHATRATH & Co LLP | For UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED | |

| Chartered Accountants | ||

| Firm Registration no: 301011E/E300025 | /s/ Sanjeev Ranjan Ambasta | |

| Sanjeev Ranjan Ambasta - General Manager Finance | ||

| /s/ Priya Agarwal | ||

| Priya Agarwal | ||

| Partner | ||

| Membership No - 303874 | ||

| Place: KOLKATA | ||

| Date: 06-02-2023 |

UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED

CONDENSED NOTES TO FINANCIAL STATEMENTS AS AT 31ST OCT, 2022

Notes:-

| 1. | The Condensed Financial Statements of UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED have been prepared in conformity with Generally Accepted Accounting Principles, to comply in all material respects with the Accounting Standards notified by the Companies (Accounting Standards) Rules, 2015 (as amended) and the relevant provisions of the Companies Act, 2013. The Financial Statements have been prepared under the historical cost convention and on Accrual Basis. The accounting policies have been constantly applied by the Company and are consistent with those used in the previous years. |

| 2. | Previous period figures have been regrouped and re-arranged whenever necessary to conform with the classification for adopting in this financial results. |

UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED

CONDENSED NOTES TO FINANCIAL STATEMENTS AS AT 31ST OCT, 2022

Note - 2: Share Capital

Oct 2022 : Average Ex Rate: 78.2378 | Mar 2022 : Average Rate: 73.9245 | |||||||||||||||||||||||

As at 31st Oct, 2022 | As at 31st March, 2022 | |||||||||||||||||||||||

| Particulars | Number of shares | Amount (Rs in Lacs) | Amount (in $K) | Number of shares | Amount (Rs in Lacs) | Amount (in $K) | ||||||||||||||||||

| A. Authorised Capital | ||||||||||||||||||||||||

| 2000000 Equity Shares of Rs. 10/- each | 2000000 | 200.00 | 255.63 | 2000000 | 200.00 | 270.55 | ||||||||||||||||||

II. Issued, Subscribed and Paid up Capital Opening Balance at the beginning of the year | 1308631 | 130.86 | 167.26 | 1308631 | 130.86 | 177.02 | ||||||||||||||||||

| Add. Addition during the year | - | 0.00 | 0.00 | - | 0.00 | 0.00 | ||||||||||||||||||

Closing Balance (1308631 number of Equity Shares @ Rs 10/-each) | 1308631 | 130.86 | 167.26 | 1308631 | 130.86 | 177.02 | ||||||||||||||||||

| Total | 1308631 | 130.86 | 167.26 | 1308631 | 130.86 | 177.02 | ||||||||||||||||||

2 (a) The Company has one class of Shares having par value of Rs 10/- each. Each Equity Shareholder is eligible for 1 vote per share held. In the event of liquidation the equity shareholders are eligible to receive the remaining assets of the Company

2 (b) Reconciliation of Shares Outstanding:

As at 31st Oct, 2022 | As at 31st March, 2022 | |||||||||||||||||||||||

| Particulars | Number of shares | Amount (Rs in Lacs) | Amount (in USD) | Number of shares | Amount (Rs in Lacs) | Amount (in USD) | ||||||||||||||||||

| Equity Shares outstanding at the beginning of the Period | ||||||||||||||||||||||||

| Equity Shares application received during the period | 1308631 | 130.86 | 16.73 | 1308631 | 130.86 | 17.70 | ||||||||||||||||||

| Equity Shires allotted during the period | ||||||||||||||||||||||||

| Equity Shares outstanding at the end of the Period | 1308631 | 130.86 | 16.73 | 1308631 | 130.86 | 17.71 | ||||||||||||||||||

2 (c) Equity Shares held by the Holding Company, the detail is given below:

As at 31st Oct, 2022 | As at 31st March, 2022 | |||||||||||||||||||||||

| Particulars | Number of shares | Percentage (%) | Number of shares | Percentage (%) | Percentage (%) | |||||||||||||||||||

| Unique Logistics Holdings Limited | 850261 | 65 | 850261 | 65 | 65 | |||||||||||||||||||

2 (d) Disclosure of Shareholders holding more than 5 percent share in the Company:

As at 31st Oct, 2022 | As at 31st March, 2022 | |||||||||||||||||||||||

| Particulars | Number of shares | Percentage (%) | Number of shares | Percentage (%) | Percentage (%) | |||||||||||||||||||

| Unique Logistics Holdings Limited | 850261 | 65 | 850261 | 65 | 65 | |||||||||||||||||||

| Frangipani Trade Services, INC., USA | 458370 | 35 | 458370 | 35 | 35 | |||||||||||||||||||

2 (e) Equity Shares held by the Promoters. The detail is given below:

As at 31st Oct, 2022 | As at 31st March, 2022 | |||||||||||||||||||||||

| Particulars | Number of shares | Percentage (%) | Number of shares | Percentage (%) | Percentage (%) | |||||||||||||||||||

| Unique Logistics Holdings Limited | 8,50,261 | 65 | 8,50,261 | 65 | 65 | |||||||||||||||||||

| Frangipani Trade Services, INC., USA | 4,58,370 | 35 | 4,58,370 | 35 | 35 | |||||||||||||||||||

2 (f) No Shares have been reserved for issue under Option and Contracts/Commitments for the sale of shares/Disinvestment as at the Balance Sheet date.

2 (g) No Shares have been allotted by way of Bonus share or pursuant to contracts or has been bought back by the Company during the period of five years preceding the date at which the

2(h) No convertible securities have been issued by the Company during the year

2 (i) No calls are unpaid by any Director, an Officer of the Company during the year

UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED

CONDENSED NOTES TO FINANCIAL STATEMENTS AS AT 31ST OCT, 2022

Note - 3: Reserves and Surplus

| Oct 2022 : Average Ex Rate: 78.2378 | Mar 2022 : Average Ex Rate: 73.9245 | |||||||||||||||

| Particulars | As at 31st Oct, 2022 Amount (Rs in lacs) | As at 31st Oct, 2022 Amount (in $K) | As at 31st March, 2022 Amount (Rs in lacs) | At at 31st March, 2022 Amount (in $K) | ||||||||||||

| (a) Securities Premium Reserve | ||||||||||||||||

| Balance Brought Forward | 81.83 | 104.59 | 81.83 | 110.70 | ||||||||||||

| Add During the year on issue of shares | - | - | ||||||||||||||

| Closing Balance | 81.83 | 104.59 | 81.83 | 110.70 | ||||||||||||

| (b) Surplus in the Statement of Profit and Loss | ||||||||||||||||

| Opening Balance as per Statement | 1,157.34 | 1,479.26 | 690.35 | 933.85 | ||||||||||||

| Add Adjustment of retained earning | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Add Profit / (Loss) during the year | 259.14 | 331.22 | 466.99 | 631.72 | ||||||||||||

| Closing Balance | 1,416.48 | 1,810.48 | 1,157.34 | 1,565.57 | ||||||||||||

| Total (a+b) | 1,498.31 | 1.915.07 | 1,239.17 | 1,676.27 | ||||||||||||

Note - 4: Long Term Borrowings

| Particulars | As at 31st Oct, 2022 Amount (Rs in Lacs) | As at 31st Oct, 2022 Amount (in $K) | As at 31st March. 2022 Amount (Rs in Lacs) | As at 31st March, 2022 Amount (in $K) | ||||||||||||

| Secured Loan | ||||||||||||||||

| HDFC Bank Car Loan - Secured against Hypothecation of Car, repayable in 3 years from date of purchase | 7.80 | 9 97 | 12.31 | 16.65 | ||||||||||||

| Total | 7.80 | 9.97 | 12.31 | 16.65 | ||||||||||||

Note - 5: Long-Term Provisions

| Particulars | As at 31sl Del. 2022 Amount (Rs in Lacs) | As at 31st Del, 2022 Amount (in $K) | As at 31st March, 2022 Amount (Rs in Lacs) | As at 31st March, 2022 Amount (in $K) | ||||||||||||

| Provision for Employee Benefits: | ||||||||||||||||

| Gratuity | 105.42 | 134.74 | 108 04 | 146.14 | ||||||||||||

| 0.00 | 0.00 | |||||||||||||||

| Other Provision: | 0.00 | 0.00 | ||||||||||||||

| Taxation | 264.15 | 337.63 | 113 37 | 153.35 | ||||||||||||

| Total | 369.57 | 472.37 | 221.40 | 299.50 | ||||||||||||

Note - 6: Short Term Borrowings

| Particulars | As at 31st Oct, 2022 Amount (Rs in Lacs) | As at 31st Oct, 2022Amount (in $K) | As at 31st March, 2022 Amount (Rs in Lacs) | As at 31st March, 2022 Amount (in $K) | ||||||||||||

| Current Matuirty Of Car Loan | ||||||||||||||||

| HDFC Bank Car Loan - Secured against Hypothecation of Car, repayable in 3 years from date of purchase | 7.79 | 9.96 | 860 | 11.64 | ||||||||||||

| Total | 7.79 | 9.96 | 8.60 | 11.64 | ||||||||||||

Note - 7: Trade Payables

| Particulars | As at 31st Del. 2022 Amount (Rs in Lacs) | As at 31st Del. 2022 Amount (in $K) | As at 31st March. 2022 Amount (Rs in Lacs) | As at 31st March. 2022 Amount (in $K) | ||||||||||||

Dues to Micro, Medium and Small Enterprises Trade Payables ( Not being covered under Micro, Small & Medium Enterprises Development Act, 2006 ): | ||||||||||||||||

| - Related Parties | 2,478.17 | 3,167.48 | 1,363.00 | 1.813.77 | ||||||||||||

| - Others | 7,129 24 | 9,112 27 | 7,380.49 | 9,983 83 | ||||||||||||

| Total | 9,607.41 | 12,279.75 | 8,743.49 | 11,827.60 | ||||||||||||

In absence of any specific information available with the Company from suppliers regarding their status under the Micro Small and Medium Enterprise Development Act, 2006, no disclosure have been considered necessary in this regard as at

Note - 8: Other Current Liabilities

| Particulars | As at 31st Oct. 2022 Amount (Rs in Lacs) | As at 31st Oct. 2022 Amount (in $K) | As at 31st March. 2022 Amount (Rs in Lacs) | As at 31st March. 2022 Amount (in $K) | ||||||||||||

| Statutory Liabilities | ||||||||||||||||

| TDS Payable | 26.85 | 34.31 | 68.80 | 93.06 | ||||||||||||

| P.F. Payable (Employer’s contribution) | 6.35 | 8.12 | 5.60 | 7.57 | ||||||||||||

| P.F. Payable (Employees contribution ) | 6.00 | 8.82 | 6.95 | 9.40 | ||||||||||||

| ESI Payable | 0.16 | 0.21 | 0.28 | 0.38 | ||||||||||||

| Professional Fax Payable | 0.62 | 0.79 | 0.15 | 0.21 | ||||||||||||

| GST Payable | 54.98 | 70.28 | 24.94 | 33.74 | ||||||||||||

| Outstanding Liability | 0.00 | 0.00 | ||||||||||||||

| Audit Fees | 4.78 | 6.11 | 4.71 | 6.37 | ||||||||||||

| Total | 100.64 | 128.61 | 111.42 | 150.72 | ||||||||||||

Note - 9: Short-Term Provisions

| Particulars | At at 31st Oct. 2022 Amount (Rs in Lacs) | As at 31st Oct, 2022 Amount (in $K) | As at 31st March, 2022 Amount (Rs in Lacs) | As at 31st March. 2022 Amount (in $K) | ||||||||||||

| Provision for Income TaX: | ||||||||||||||||

| Provision for Income Tax Current year | 91.00 | 116.31 | 150.79 | 203.98 | ||||||||||||

| Provision for Employee Benefits: | 0.00 | 0.00 | ||||||||||||||

| Gratuity | 17.16 | 21.93 | 11.66 | 15.78 | ||||||||||||

| Leave Encashment | 14.96 | 19.13 | 20.54 | 27.79 | ||||||||||||

| Bonus & Ex-Gratia | 37.01 | 47.31 | 48.49 | 65.59 | ||||||||||||

| LTA | 1.06 | 1.35 | 4.59 | 6.20 | ||||||||||||

| Salaries | 2.42 | 3.09 | 84.86 | 114.79 | ||||||||||||

| Medical Reimbursement | 0.40 | 0.62 | 5.37 | 7.27 | ||||||||||||

| Other Provision: | 0.00 | 0.00 | ||||||||||||||

| Others | 8.31 | 10.62 | 6.35 | 8.59 | ||||||||||||

| Total | 172.40 | 220.35 | 332.65 | 449.99 | ||||||||||||

UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED

CONDENSED NOTES TO FINANCIAL STATEMENTS AS AT 31ST

Note - 11: Long-Term Loans and Advances

Oct 2022 : Average Ex Rate : 78.2378 | Mar 2022 : Average Ex Rate : 73.9245 | |||||||||||||||

| Particulars | As at 31st Oct, 2022 Amount (Rs in Lacs) | As at 31st Oct, 2022 Amount (in $K) | As at 31st March, 2022 Amount (Rs in Lacs) | As at 31st March, 2022 Amount (in $K) | ||||||||||||

| Unsecured considered Good | ||||||||||||||||

Security Deposit | 66.79 | 85.36 | 54.63 | 73.90 | ||||||||||||

| TDS Receivable | 194.50 | 248.60 | 250.49 | 338.84 | ||||||||||||

| Total | 261.28 | 333.96 | 305.12 | 412.74 | ||||||||||||

Note - 12: Trade receivables

| Particulars | As at 31st Oct. 2022 Amount (Rs in Lacs) | As at 31st Oct, 2022 Amount (in $K) | As at 31st March, 2022 Amount (Rs in l.acs) | As at 31st March, 2022 Amount (in $K) | ||||||||||||

| Trade Receivables | ||||||||||||||||

| Unsecured Considered Good | 8,919.55 | 11,400.57 | 8,696 56 | 11,764.12 | ||||||||||||

| Unsecured Considered Doubtful | 19.96 | 25.51 | 12.96 | 17.53 | ||||||||||||

| Less Provision for Doubtful Debts | 19.96 | 25.51 | 12.96 | 17.53 | ||||||||||||

| Total | 8,919.55 | 11,400.57 | 8,722.48 | 11,764.12 | ||||||||||||

Note - 13: Cash and Cash Equivalents

| Particulars | As at 31st Oct, 2022 Amount (Rs in Lacs) | As at 31st Oct, 2022 Amount (in $K) | As at 31st March, 2022 Amount (Rs in Lacs) | As at 31st March, 2022 Amount (in $K) | ||||||||||||

| Cash in hand | 0.32 | 0.40 | 0.51 | 0.69 | ||||||||||||

| Balances with Banks in Current Accounts | 198.29 | 253.44 | 849 61 | 1,149.29 | ||||||||||||

| Fixed Deposit with HSBC Bank | 1,605.00 | 2,051.44 | 155.00 | 209.67 | ||||||||||||

| Total | 1,803.60 | 2,305.28 | 1005.12 | 1,359.66 | ||||||||||||

Note - 14: Short-Term Loans and Advances

| Particulars | As at 31st Oct, 2022 Amount (Rs in Lacs) | As at 31st Oct, 2022 Amount (in $K) | As at 31st March, 2022 Amount (Rs in Lacs) | As at 31st March, 2022 Amount (in $K) | ||||||||||||

| (Unsecured, Considered Good) | 0 | 0 | ||||||||||||||

| Prepaid Expenses | 27.00 | 34.51 | 11.83 | 16.00 | ||||||||||||

| Staff Advance | 6.72 | 8.59 | 9.93 | 13.44 | ||||||||||||

| Total | 33.72 | 43.10 | 21.77 | 29.44 | ||||||||||||

Note - 15: Other Current Asset

| Particulars | As at 31st Oct, 2022 Amount (Rs in Lacs) | As at 31st Oct, 2022 Amount (in $K) | As at 31st March, 2022 Amount (Rs in Lacs) | As at 31st March, 2022 Amount (in $K) | ||||||||||||

| (Unsecured, Considered Good) | ||||||||||||||||

| GST Receivable | 44 32 | 56.65 | 57.44 | 77.70 | ||||||||||||

| Accrued Interest on Fixed Deposit | 10.66 | 13.63 | 241 | 3.26 | ||||||||||||

| TDS Receivable - Current | 700.64 | 895.53 | 593.25 | 802.50 | ||||||||||||

| Advance Paid to Suppliers | 0.00 | 0.00 | 20.35 | 27.52 | ||||||||||||

| Total | 755.62 | 965.81 | 673.44 | 910.98 | ||||||||||||

UNIQUE LOGISTICS INTERNATIONAL (INDIA) PRIVATE LIMITED

NOTES IO FINANCIAL STATEMENTS AS AT 31ST OCT, 2022

Note - 16: Revenue from Operations

| Oct 2022 : Average Ex Rate : 78.2378 | Oct 2021 : Average Rate : 73.9245 | |||||||||||||||

| Particulars | For

the seven months period ended 31st Oct, 2022 Amount (Rs in Lacs) | For

the seven months period ended 31st Oct, 2022 Amount (in $K) | For

the seven months period ended 31st Oct, 2021 Amount (Rs in Lacs) | For

the seven months period ended 31st Oct, 2021 Amount (in $K) | ||||||||||||

| Services | ||||||||||||||||

| Logistic Services provided to customer | 21,877.62 | 27,962.98 | 30,916 22 | 41,821.34 | ||||||||||||

| Total | 21,877.62 | 27,962.98 | 30,916.22 | 41,821.34 | ||||||||||||

Note - 17: Other Income

| Particulars | For the seven months period ended 31st Oct, 2022 Amount (Rs in Lacs) | For the seven months period ended 31st Oct, 2022 Amount (in $K) | For the seven months period ended 31st Oct, 2021 Amount (Rs in l.acs) | For the seven months period ended 31st Oct, 2021 Amount (in $K) | ||||||||||||

| Interest Income | ||||||||||||||||

| Interest on Income Tax

Refund | - | - | - | |||||||||||||

| Bank Interest

Income | 17 57 | 22.46 | 0.02 | 0.03 | ||||||||||||

| Other Non-Operating Income | 0.00 | 0.00 | ||||||||||||||

| Other Income | 0.15 | 0.19 | 2.87 | 3.88 | ||||||||||||

| Foreign Exchange Difference ( Net ) | 100.43 | 128.36 | 0.73 | 0.99 | ||||||||||||

| Total | 118.15 | 151.01 | 3.62 | 4.90 | ||||||||||||

Note - 18: Operational Expenses

| Particulars | For the seven months period ended 31st Oct, 2022 Amount (Rs in Lacs) | For the seven months period ended 31st Oct, 2022 Amount (in $K) | For the seven mouths period ended 31st Oct, 2021 Amount (Rs in l.acs) | For the seven months period ended 31st Oct, 2021 Amount (in $K) | ||||||||||||

| Direct Expenses | 20,188.21 | 25,803.66 | 29,313.33 | 39,653.06 | ||||||||||||

| Total | 20,188.21 | 25,803.66 | 29.313.33 | 39,653.06 | ||||||||||||

Note - 19: Employee Benefits Expense

| Particulars | For the seven months period ended 31st Oct, 2022 Amount (Rs in l.acs) | For the seven months period ended 31st Oct, 2022 Amount (in $K) | For the seven months period ended 31st Oct, 2021 Amount (Rs in l.acs) | For the seven months period ended 31st Oct, 2021 Amount (in $K) | ||||||||||||

| Salaries & Wages | 945.85 | 1208 95 | 856.67 | 1,158 85 | ||||||||||||

| Contribution to Gratuity. Bonus & Ex-Gralia | 48.10 | 61.48 | 49.09 | 66.41 | ||||||||||||

| Contribution to Provident Fund & ESI | 93.29 | 119.24 | 96.33 | 130.31 | ||||||||||||

| Staff Welfare Expenses | 15.09 | 19 29 | 10 05 | 13 60 | ||||||||||||

| Total | 1,102.33 | 1,408.95 | 1,012.15 | 1,369.16 | ||||||||||||

Note - 20: Finance Cost

| Particulars | For the seven months period ended 31st Oct, 2022 Amount (Rs in l.acs) | For the seven mouths period ended 31st Oct, 2022 Amount (in $K) | For the seven mouths period ended 31st Oct, 2021 Amount (Rs in l.acs) | For the seven months period ended 31st Oct, 2021 Amount (in $K) | ||||||||||||

| Interest on HSBC Bank Over Draft | - | 0 | 0.74 | 1.00 | ||||||||||||

| Interest A/C-Company Car loan | 0.83 | 1.07 | 0.34 | 0.47 | ||||||||||||

| Total | 0.83 | 1.07 | 1.08 | 1.46 | ||||||||||||

Note - 21: Depreciation & Amortisation Expense

| Particulars | For

the seven months period ended 31st Oct. 2022 Amount (Rs in Lacs) | For

the seven months period ended 31st Oct, 2022 Amount (in $K) | For

the seven months period ended 31st Oct, 2021 Amount (Rs in l.acs) | For

the seven mouths period ended 31st Oct, 2021 Amount (in $K) | ||||||||||||

| Depreciation for the year | 21.10 | 26.97 | 12.22 | 16 53 | ||||||||||||

| Total | 21.10 | 26.97 | 12.22 | 16.53 | ||||||||||||

Note - 22: Other Expenses

| Particulars | For

the seven months period ended 31st Oct, 2022 Amount (Rs in l.acs) | For

the seven months period ended 31st Oct, 2022 Amount (in $K) | For

the seven months period ended 31st Oct. 2021 Amount (Rs in l.acs) | For

the seven months period ended 31st Oct. 2021 Amount (in $K) | ||||||||||||

| Advertising | 0.36 | 0.46 | 0.00 | 0.00 | ||||||||||||

| Audit fees | 2.76 | 3.53 | 2.81 | 3.80 | ||||||||||||

| Bank Charges | 19 47 | 24.89 | 7.83 | 10.60 | ||||||||||||

| Provision for Bad and Doubtful debts | 7.00 | 8.95 | 7.00 | 9.47 | ||||||||||||

| Brokerage and Commission | 2.78 | 3.55 | 0.00 | 0.00 | ||||||||||||

| Asset Written off | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Business Promotion | 6.75 | 8.63 | 0.97 | 1 31 | ||||||||||||

| Conference Expenses | 4.33 | 5.53 | 0.00 | 0.00 | ||||||||||||

| Car Hire Charges | 1.73 | 2.21 | 0.77 | 1.04 | ||||||||||||

| Car Maintenance | 0.99 | 1.26 | 0.84 | 1.13 | ||||||||||||

| Cleaning | 7.13 | 9.12 | 6.28 | 8.50 | ||||||||||||

| Consultancy | 8.10 | 10.35 | 4.14 | 5.61 | ||||||||||||

| Conveyance | 7.47 | 9.54 | 7.32 | 9.91 | ||||||||||||

| Courier | 4.72 | 6.03 | 2.98 | 4.03 | ||||||||||||

| Subscriptions | 4.93 | 6.31 | 3.86 | 5.22 | ||||||||||||

| Donation | 0.05 | 0.06 | 0.00 | 0.00 | ||||||||||||

| Electricity | 20.56 | 26.27 | 16.03 | 21.69 | ||||||||||||

| Entertainment | 0 52 | 0.66 | 0.76 | 1.02 | ||||||||||||

| Employee fuel Expenses Reimbursement | 22.19 | 28.36 | 18.54 | 25.08 | ||||||||||||

| Foreign Exchange Difference ( Net ) | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Insurance | 1.19 | 1.52 | 1.03 | 1.40 | ||||||||||||

| Insurance Overseas | 6.30 | 8.05 | 3.72 | 5.03 | ||||||||||||

| Penally | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Legal & professional fees | 6.60 | 8.44 | 4.73 | 6.40 | ||||||||||||

| Office Expenses | 3.45 | 4.41 | 3.08 | 4.17 | ||||||||||||

| Printing & Stationary | 12.75 | 16.29 | 10.77 | 14.57 | ||||||||||||

| Professional Tax (Company) | 0.10 | 0.13 | 0 26 | 0.36 | ||||||||||||

| Rent | 110.24 | 140.91 | 92.26 | 124.81. | ||||||||||||

| Repairs & Maintenance - Computer Maintenance | 8.45 | 10.80 | 7.78 | 10.52 | ||||||||||||

| Repairs & Maintenance - Others | 25.70 | 32.85 | 19.17 | 25.94 | ||||||||||||

| Integrated GST Expenses | 0.11 | 0.14 | 0.00 | 0.00 | ||||||||||||

| Central GST Expenses | 3.01 | 3.85 | 0.00 | 0.00 | ||||||||||||

| State GST Expenses | 0 18 | 0 23 | 0.00 | 0.00 | ||||||||||||

| Taxes / Licenses | 0.17 | 0.22 | 0.19 | 0.25 | ||||||||||||

| Telephone and Internet | 10.80 | ‘ | 13.81 | 8.82 | 11.93 | |||||||||||

| Training | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Travelling Expenses | 12.72 | 16 26 | 2.33 | 3.15 | ||||||||||||

| Misc. Expenses | 0.35 | 0.45 | 0.04 | 0.05 | ||||||||||||

| Manpower Supply service | 0.00 | 0.00 | 0.00 | 0.00 | ||||||||||||

| Interest & Penaltv-GST | 5.96 | 7.62 | 0.07 | 0.09 | ||||||||||||

| Total | 329.91 | 421.68 | 234.38 | 317.06 | ||||||||||||

Note - 23: Current Tax

| Particulars | For

the seven months period ended 31st Oct, 2022 Amount (Rs in l.acs) | For

the seven months period ended 31st Oct, 2022 Amount (in $K) | For

the seven months period ended 31st Oct, 2021 Amount (Rs in l.acs) | For

the seven months period ended 31st Oct, 2021 Amount (in $K) | ||||||||||||

| Provision for Taxation | 91.00 | 116.31 | 88.75 | 120.05 | ||||||||||||

| Total | 91.00 | 116.31 | 88.75 | 120.05 | ||||||||||||

Note - 24: Deferred Tax Expense / (Income)

| Particulars | For

the seven months period ended 31st Oct. 2022 (Rs in l.acs) | For the seven months period ended 31st Oct. 2022 Amount (in $K) | For

the seven months period ended (Rs in l.acs) | For

the seven months period ended (in $K) | ||||||||||||

| Deferred Tax Expense/ (Income) | 3.25 | 4.15 | - | - | ||||||||||||

| Total | 3.25 | 4.15 | - | - | ||||||||||||

Note - 25: Earning Per Share

| For the seven months period ended 31st Oct, 2022 | For the seven months period ended 31st Oct, 2022 | For

the seven months period ended 31st Oct, 2021 | For

the seven months period ended 31st Oct, 2021 | |||||||||||||

| Particulars | Amount (Rs in l.acs) | Amount (in $K) | Amount (Rs in Lacs) | Amount (in $K) | ||||||||||||

| Basic | ||||||||||||||||

| (i) Weighted average number of Equity Shares of Rs. 10 each outstanding during the period | 13,08,631 | 13,08,631 | 13,08.631 | 13,08,631 | ||||||||||||

| (ii) Net Profit/(Loss) for the year | 259.14 | 331.22 | 257.93 | 348 91 | ||||||||||||

| (iii) Basic Earnings per Share [(ii)/(i)] (in Rs.) | 19.80 | 0.25 | 19.71 | 0.26 | ||||||||||||

(On the letter head of the auditor)

RECONCILIATION OF FINANCIAL STATEMENTS TO US GAAP

To: Unique Logistics International Inc.

Re: Unique Logistics International (INDIA) Pvt. Ltd. Reconciliation of Financial Statements to United States Generally Accepted Accounting Principles

We have audited the Financial Statements of Unique Logistics International (INDIA) Pvt. Ltd., as of October 31, 2022, which comprise the Balance Sheet as at October 31, 2022, the Statement of Profit and Loss, including the Statement of other comprehensive income, the Cash Flow Statement and notes to the financial statements, including a summary of significant accounting policies and other explanatory information.

The below mentioned reconciliation statement of the Indian GAAP financial statements to United States generally accepted accounting principles (U.S. GAAP) as at 31st October, 2022, has been prepared following the same accounting policies and methods of computation as the reconciliation of the consolidated financial statements to U.S. GAAP for the period ended October 31, 2022. The disclosures provided below are incremental to those included with the financial statements and the reconciliation of those financial statements to U.S. GAAP.

The significant differences between Indian generally accepted accounting principles (IGAAP) as they apply to Unique Logistics are as follows:

| 1. | As per ASC 606, the core principle is that a vendor should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the vendor expects to be entitled in exchange for those goods or services. The revenue recognition is on the basis of allocation of the transaction price over the performance obligation and fulfillment of performance obligation. |

As per Indian GAAP revenue recognition criteria depend on the category of revenue transaction. In general criteria includes no significant uncertainty exists regarding the amount of the consideration that will be derived from the sale of goods/rendering of services.

The reporting entity (Unique Logistics International (India) Pvt. Ltd.) broadly recognize revenue which is in principal similar to US GAAP revenue recognition criteria. The revenue is recognized on the basis of performance obligation as defined in the service contract.

| 2. | As per ASC 842 there is a requirement that lessee to record operating leases on the balance sheet. As a result, lease liability will be recorded at the present value of future lease obligations and Right of Use (ROU) asset, which represents lease right to use the underlying asset, are recorded at commencement date. Rental charges for operating leases shall be straight lined over the period of the agreement considering the escalation prices and the net activity in lease liability and ROU asset is essentially rent equalization reserve and same shall be created for USD 16,541 as on 31st October 2022. |

| 3. | ASC 830 states that, a reporting entity must use a “functional-currency approach” in which all transactions are first measured in the currency of the primary economic environment in which the reporting entity operates (i.e., the functional currency) and then translated into the reporting currency. Statement of Profit and Loss has been translated from Indian Rupees (INR) to United States Dollar (USD) using average rate of 1USD = INR 78.238. Balance Sheet has been translated from Indian Rupees (INR) to United States Dollar (USD) using closing rate of 1USD = INR 82.393. Impact of Increase (Decrease) in financial position due to creation of rent equalization reserve has been translated using average rate. |

The application of U.S. GAAP would have the following effect on the financial statements:

| Period up to October 31,2022 | ||||||||

| Particulars | INR | USD | ||||||

| Revenue from Operations | 2,18,77,62,413 | 2,79,62,971 | ||||||

| Cost of Revenue | 2,01,88,21,476 | 2,58,03,645 | ||||||

| Operating Expenses: | ||||||||

| Depreciation and amortization | 21,09,785 | 26,966 | ||||||

| Employee benefit expense | 11,02,33,246 | 14,08,951 | ||||||

| Other Expense | 3,29,91,000 | 4,21,676 | ||||||

| Total Operating expenses | 14,53,34,031 | 18,57,593 | ||||||

| Income from operations | 2,36,06,906 | 3,01,733 | ||||||

| Other (Income) Expenses: | ||||||||

| Interest Expenses | 83,000 | 1,061 | ||||||

| Other Income | 1,18,14,888 | 1,51,012 | ||||||

| Total Other(Income) Expenses | 1,17,31,888 | 1,49,952 | ||||||

| Income (loss) before income taxes | 3,53,38,794 | 4,51,684 | ||||||

| Tax expense (benefit) | 94,25,000 | 1,20,466 | ||||||

| Net income (loss) for the period, as reported | 2,59,13,794 | 3,31,218 | ||||||

| Adjustments: | ||||||||

| Rent equalisation reserve | 12,94,148 | 16,541 | ||||||

| Net income – U.S. GAAP | 2,46,19,646 | 3,14,677 | ||||||

| Foreign Currency Translation Reserve | 0 | 0 | ||||||

| Comprehensive income – U.S. GAAP | 2,46,19,646 | 3,14,677 | ||||||

*Financial statements have been translated from Indian Rupees (INR) to United States Dollar (USD) using average rate of 1USD = INR 78.238 for Income Statement.

| As at October 31, 2022 | As Reported | Increase (Decrease) | US GAAP | |||||||||||||||||||||

| INR | USD | INR | USD | INR | USD | |||||||||||||||||||

| Asset | ||||||||||||||||||||||||

| Current Assets: | ||||||||||||||||||||||||

| Cash and cash equivalents | 18,03,60,403 | 21,89,015 | - | - | 18,03,60,403 | 21,89,015 | ||||||||||||||||||

| Accounts receivable, net | 89,19,55,452 | 1,08,25,569 | - | - | 89,19,55,452 | 1,08,25,569 | ||||||||||||||||||

| Prepayments and other current assets | 7,89,34,988 | 9,58,026 | - | - | 7,89,34,988 | 9,58,026 | ||||||||||||||||||

| Total current assets | 1,15,12,50,843 | 1,39,72,610 | - | - | 1,15,12,50,843 | 1,39,72,610 | ||||||||||||||||||

| Property and equipment, net | 81,10,998 | 98,442 | - | - | 81,10,998 | 98,442 | ||||||||||||||||||

| Intangible assets, net | - | - | - | - | - | - | ||||||||||||||||||

| Other long term assets | 2,61,28,380 | 3,17,117 | 83,09,981 | 1,00,857 | 3,44,38,361 | 4,17,975 | ||||||||||||||||||

| Deferred Tax Asset | 39,88,197 | 48,404 | - | - | 39,88,197 | 48,404 | ||||||||||||||||||

| Total Assets | 1,18,94,78,418 | 1,44,36,574 | 83,09,981 | 1,00,857 | 1,19,77,88,399 | 1,45,37,431 | ||||||||||||||||||

| Liabilities and stockholders’ equity | ||||||||||||||||||||||||

| Current liabilities: | ||||||||||||||||||||||||

| Accounts payable | 96,07,40,659 | 1,16,60,408 | - | - | 96,07,40,659 | 1,16,60,408 | ||||||||||||||||||

| Accrued expenses and other liabilities | 2,80,83,365 | 3,40,845 | - | - | 2,80,83,365 | 3,40,845 | ||||||||||||||||||

| Total current liabilities | 98,88,24,024 | 1,20,01,253 | - | - | 98,88,24,024 | 1,20,01,253 | ||||||||||||||||||

| Other long-term liabilities | 3,77,37,128 | 4,58,012 | 96,04,129 | 1,16,564 | 4,73,41,257 | 5,74,576 | ||||||||||||||||||

| Total liabilities | 1,02,65,61,152 | 1,24,59,264 | 96,04,129 | 1,16,564 | 1,03,61,65,281 | 1,25,75,829 | ||||||||||||||||||

| Stockholders’ equity | ||||||||||||||||||||||||

| Common Stock | 1,30,86,310 | 1,58,827 | - | - | 1,30,86,310 | 1,58,827 | ||||||||||||||||||

| Reserve and Surplus | 14,98,30,955 | 18,18,482 | -12,94,148 | -15,707 | 14,85,36,807 | 18,02,776 | ||||||||||||||||||

| Total liabilities and stockholders’ equity | 1,18,94,78,418 | 1,44,36,574 | 83,09,981 | 1,00,857 | 1,19,77,88,399 | 1,45,37,431 | ||||||||||||||||||

*Financial statements have been translated from Indian Rupees (INR) to United States Dollar (USD) using closing rate of 1USD = INR 82.393 for Financial Positions. Increase (Decrease) in financial position is occurring due to creation of rent equalization reserve which has been translated at average rate.

** Other long term assets include Right of Use (ROU) assets and other long term liabilities include lease liability created for the lease term as per ASC 842.

For B M CHATRATH & CO LLP

CHARTERED ACCOUNTANTS

Firm Registration No. 301011E/E300025

Partner

Membership No.:

Place:

Date: